Federal Supplemental Education Opportunity Grants: Unlocking Financial Aid Opportunities

The Federal Supplemental Education Opportunity Grant (FSEOG) program is a vital resource for students seeking financial assistance to pursue their educational goals. This comprehensive guide aims to provide an in-depth understanding of the FSEOG, its eligibility criteria, application process, and the benefits it offers to eligible students. By the end of this article, you will have a clear roadmap to navigate the FSEOG program and maximize your chances of securing financial aid for your higher education.

Understanding the FSEOG Program

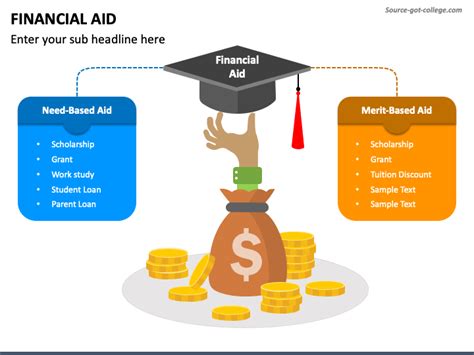

The Federal Supplemental Education Opportunity Grant is a need-based grant program designed to support students with exceptional financial need. It is a form of financial aid that does not require repayment, making it an attractive option for students facing financial challenges. The FSEOG program is administered by the U.S. Department of Education and is available to students enrolled in participating post-secondary institutions.

Eligibility Criteria

To be eligible for the FSEOG, students must meet the following criteria:

- Financial Need: The primary consideration for FSEOG eligibility is the demonstration of exceptional financial need. Students with the lowest Expected Family Contributions (EFC) are given priority.

- Enrollment Status: Students must be enrolled or accepted for enrollment as regular students in a participating post-secondary institution. This includes colleges, universities, and certain career schools.

- U.S. Citizenship or Eligible Non-Citizen: Only U.S. citizens, U.S. nationals, or eligible non-citizens (such as permanent residents) are eligible for the FSEOG.

- Satisfactory Academic Progress: Students must maintain satisfactory academic progress as defined by their institution to remain eligible for the grant.

- Free Application for Federal Student Aid (FAFSA): Completing the FAFSA is a crucial step in determining eligibility for the FSEOG and other federal financial aid programs.

Application Process

The application process for the FSEOG is straightforward and typically involves the following steps:

- Complete the FAFSA: Start by filling out the Free Application for Federal Student Aid. This application provides an assessment of your financial need and is the basis for determining your eligibility for various federal financial aid programs, including the FSEOG.

- Check Eligibility: Once your FAFSA is processed, you will receive a Student Aid Report (SAR) outlining your Expected Family Contribution (EFC). If your EFC falls within the range eligible for the FSEOG, you may proceed with the next steps.

- Contact Your School’s Financial Aid Office: Reach out to the financial aid office at your chosen post-secondary institution. They will guide you through the specific application requirements and deadlines for the FSEOG at their school.

- Submit Required Documentation: Gather and submit any additional documentation requested by your financial aid office. This may include tax returns, W-2 forms, or other financial records to verify your financial need.

- Wait for Award Notification: After submitting your application and supporting documents, your financial aid office will review your information and determine your eligibility for the FSEOG. You will receive an award notification outlining the amount of grant you are eligible to receive.

Benefits of the FSEOG

The Federal Supplemental Education Opportunity Grant offers several significant benefits to eligible students:

- Financial Support: The FSEOG provides much-needed financial assistance to students with exceptional financial need. The grant amount can range from a few hundred dollars to several thousand dollars, depending on your financial situation and the availability of funds at your institution.

- Non-Repayment: Unlike loans, the FSEOG does not require repayment. This means that the grant money you receive is a gift that does not need to be paid back, even if you withdraw from school or graduate.

- Supplemental Aid: The FSEOG is designed to supplement other forms of financial aid, such as scholarships, work-study programs, and federal student loans. It can help bridge the gap between your financial resources and the cost of your education.

- Priority for Low-Income Students: The FSEOG program gives priority to students with the lowest Expected Family Contributions. This ensures that students from low-income backgrounds have access to additional financial support to pursue their educational aspirations.

How to Maximize Your FSEOG Eligibility

To increase your chances of receiving the FSEOG and maximizing the grant amount, consider the following strategies:

- Complete the FAFSA Early: Submitting your FAFSA as early as possible increases your chances of being considered for the FSEOG. Funds for the grant are limited, and some schools may award FSEOGs on a first-come, first-served basis.

- Provide Accurate Information: Ensure that all the information you provide on your FAFSA and other financial aid applications is accurate and up-to-date. Inaccurate information can lead to delays or disqualification from the FSEOG.

- Explore Other Financial Aid Options: While the FSEOG is a valuable resource, it is essential to explore other financial aid options as well. Consider scholarships, work-study programs, and federal student loans to create a comprehensive financial aid package.

- Maintain Good Academic Standing: To remain eligible for the FSEOG and other financial aid, it is crucial to maintain satisfactory academic progress. Stay on top of your studies and meet the academic requirements set by your institution.

Disbursement and Usage of FSEOG Funds

Once you have been awarded the FSEOG, the financial aid office at your institution will disburse the funds according to their policies. The grant money can be used to cover various educational expenses, including:

- Tuition and Fees: The FSEOG can help cover the cost of your tuition and mandatory fees associated with your program of study.

- Books and Supplies: You can use the grant funds to purchase textbooks, course materials, and other supplies necessary for your courses.

- Room and Board: If you live on campus or have housing expenses related to your education, the FSEOG can contribute to these costs.

- Transportation: The grant can assist with transportation expenses, such as commuting costs or travel related to your educational pursuits.

- Other Educational Expenses: The FSEOG may also be applied to other approved educational expenses, such as technology fees, lab fees, or other institution-specific charges.

Renewal and Continued Eligibility

To maintain your eligibility for the FSEOG and other financial aid, it is essential to renew your FAFSA annually. Additionally, you must continue to meet the satisfactory academic progress requirements set by your institution. By staying on track with your studies and maintaining good academic standing, you can ensure continued access to financial aid, including the FSEOG.

Tips for Successful FSEOG Application

- Stay Organized: Keep track of important deadlines, required documentation, and contact information for your financial aid office.

- Communicate with Your Financial Aid Office: If you have questions or concerns about the FSEOG or any other financial aid program, reach out to your financial aid office for guidance and support.

- Understand the Terms and Conditions: Familiarize yourself with the terms and conditions of the FSEOG and any other financial aid you receive. This includes understanding the implications of withdrawing from courses or changing your enrollment status.

- Monitor Your Financial Aid Package: Regularly review your financial aid award letter and ensure that all the information is accurate. If you have any questions or concerns, contact your financial aid office promptly.

The Role of Financial Aid Counselors

Financial aid counselors at your institution play a crucial role in guiding you through the FSEOG and other financial aid processes. They are trained to assist students in navigating the complex world of financial aid and ensuring that you receive the support you need to pursue your educational goals. Don’t hesitate to reach out to your financial aid counselor for personalized advice and support.

FAQs

Can I receive the FSEOG if I am already receiving other forms of financial aid?

+Yes, the FSEOG is designed to supplement other forms of financial aid. However, the total amount of aid you receive, including the FSEOG, cannot exceed your financial need as determined by your institution.

Are there any income limits for FSEOG eligibility?

+While the FSEOG is primarily need-based, there are no strict income limits for eligibility. The Expected Family Contribution (EFC) calculated through the FAFSA is the primary factor in determining your eligibility for the FSEOG.

Can I receive the FSEOG if I am a part-time student?

+Yes, part-time students are eligible for the FSEOG as long as they meet the other eligibility criteria, including financial need and enrollment status.

What happens if I receive more financial aid than I need?

+If you receive more financial aid, including the FSEOG, than your calculated financial need, your institution may reduce or cancel your FSEOG award. It is essential to provide accurate financial information to ensure you receive the appropriate amount of aid.

Can I use the FSEOG for study abroad programs?

+The FSEOG can be used for study abroad programs if your institution approves the program and includes it in your financial aid package. It is essential to discuss your study abroad plans with your financial aid office to ensure you receive the necessary funding.

Conclusion

The Federal Supplemental Education Opportunity Grant is a valuable resource for students facing financial challenges in pursuing their higher education. By understanding the eligibility criteria, navigating the application process, and maximizing your financial aid package, you can unlock the benefits of the FSEOG and take a significant step towards achieving your educational goals. Remember, financial aid counselors are there to support you, so don’t hesitate to reach out for guidance and assistance throughout your journey.