Introduction

When it comes to financial analysis and investment evaluation, one metric that often takes center stage is the Compound Annual Growth Rate (CAGR). It provides valuable insights into the performance of investments over a specific period. In this comprehensive guide, we will delve into the world of CAGR calculations using Excel formulas. Whether you’re an investor, analyst, or simply interested in mastering this essential financial concept, this article will equip you with the knowledge and tools to become a CAGR calculation expert.

Understanding CAGR

Before we dive into the formulas, let’s briefly understand what CAGR represents. The Compound Annual Growth Rate is a financial metric used to measure the average annual growth rate of an investment over a given period. It considers the initial and final values of the investment, as well as the number of years between them. By calculating CAGR, you can determine the average rate at which your investment has grown, providing a clear indication of its performance.

Basic CAGR Formula

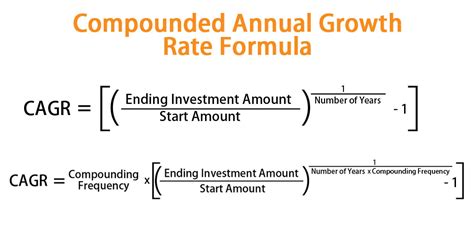

The fundamental formula for calculating CAGR is relatively straightforward:

CAGR = (Ending Value / Starting Value)^(1 / Number of Years) - 1

Let’s break down the components:

- Ending Value: This represents the final value of your investment at the end of the period.

- Starting Value: It is the initial value of your investment at the beginning of the period.

- Number of Years: This is the duration of the investment period, expressed in years.

Excel Formulas for CAGR Calculation

Now, let’s explore the Excel formulas that will empower you to calculate CAGR with ease.

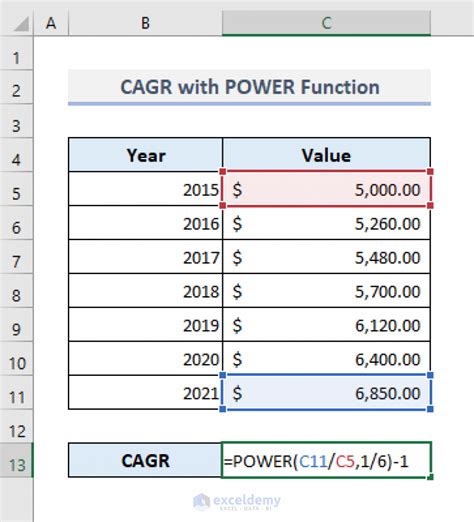

Formula 1: Basic CAGR Formula

You can use the basic CAGR formula in Excel by following these steps:

- Input the Starting Value: In a cell, enter the initial value of your investment.

- Input the Ending Value: In another cell, enter the final value of your investment.

- Input the Number of Years: In a separate cell, enter the duration of the investment period in years.

- Apply the Formula: In an empty cell, use the following formula:

=(Ending_Value / Starting_Value)^(1 / Number_of_Years) - 1

Replace Ending_Value, Starting_Value, and Number_of_Years with the appropriate cell references.

Formula 2: Using the RATE Function

Excel’s RATE function can also be utilized to calculate CAGR. Here’s how:

- Input the Number of Periods: In a cell, enter the total number of periods (usually months) in your investment period.

- Input the Payment Amount: In another cell, enter the amount you invest or receive during each period.

- Input the Present Value: In a separate cell, enter the initial value of your investment.

- Input the Future Value: In a cell, enter the final value of your investment.

- Apply the Formula: In an empty cell, use the following formula:

=RATE(Number_of_Periods, Payment_Amount, Present_Value, Future_Value, 0)

Replace Number_of_Periods, Payment_Amount, Present_Value, and Future_Value with the appropriate cell references.

Formula 3: Combining the RATE and POWER Functions

By combining the RATE and POWER functions, you can achieve a more flexible CAGR calculation:

- Input the Number of Periods: As before, enter the total number of periods in your investment period.

- Input the Payment Amount: Repeat the step from Formula 2.

- Input the Present Value: Repeat the step from Formula 2.

- Input the Future Value: Repeat the step from Formula 2.

- Apply the Formula: In an empty cell, use the following formula:

=RATE(Number_of_Periods, Payment_Amount, Present_Value, Future_Value, 0) ^ (1 / Number_of_Years) - 1

Replace the placeholders with the appropriate cell references.

Advanced CAGR Calculations

In some cases, you might encounter more complex scenarios where the investment period is not a whole number of years. Excel offers additional formulas to handle such situations.

Formula 4: Calculating CAGR with Non-Integer Years

When dealing with non-integer years, you can utilize the IRR (Internal Rate of Return) function:

- Input the Cash Flows: In a range of cells, enter the cash flows for each period, starting with the initial investment as a negative value.

- Apply the Formula: In an empty cell, use the following formula:

=IRR(Cash_Flows, Guess_Rate)

Replace Cash_Flows with the range of cells containing the cash flows, and Guess_Rate with an estimated rate of return (e.g., 0.1 for 10%).

Formula 5: Adjusting for Inflation

To calculate CAGR while considering the impact of inflation, you can use the XIRR (Extended Internal Rate of Return) function:

- Input the Cash Flows: Similar to Formula 4, enter the cash flows for each period.

- Input the Dates: In a separate column, enter the dates corresponding to each cash flow.

- Apply the Formula: In an empty cell, use the following formula:

=XIRR(Cash_Flows, Dates, Guess_Rate)

Replace Cash_Flows with the range of cells containing the cash flows, Dates with the range of cells containing the corresponding dates, and Guess_Rate with an estimated rate of return.

Tips and Best Practices

- Data Accuracy: Ensure that your input data, including starting values, ending values, and investment periods, is accurate and up-to-date.

- Currency Consistency: Maintain consistency in the currency used throughout your calculations to avoid discrepancies.

- Rounding: Consider rounding your calculated CAGR to a reasonable number of decimal places for better readability.

- Scenario Analysis: Experiment with different investment scenarios by varying the input values to understand the impact on CAGR.

Visualizing CAGR

To enhance your understanding and communicate your findings effectively, consider visualizing your CAGR calculations. Excel offers various charting options to present your data visually:

- Line Chart: Create a line chart to illustrate the growth of your investment over time, with the CAGR as a reference line.

- Bar Chart: Use a bar chart to compare the performance of multiple investments or scenarios, highlighting the CAGR for each.

- Scatter Plot: Explore the relationship between time and investment value using a scatter plot, with the CAGR as a trendline.

Conclusion

Mastering the art of CAGR calculation is an invaluable skill for anyone involved in financial analysis or investment evaluation. By leveraging Excel’s powerful formulas and functions, you can efficiently determine the average annual growth rate of your investments. Whether you’re analyzing past performance or projecting future growth, the techniques outlined in this guide will empower you to make informed decisions and optimize your investment strategies. Remember to adapt the formulas to your specific needs and explore the vast possibilities Excel offers for financial modeling and analysis. Happy calculating!

What is the significance of CAGR in investment analysis?

+CAGR provides a clear understanding of the average annual growth rate of an investment, helping investors evaluate its performance over time.

Can I use CAGR for short-term investments?

+While CAGR is typically used for long-term investments, it can still be applied to short-term investments to analyze their performance.

How does CAGR differ from simple annual growth rate?

+CAGR considers the compounding effect of growth over time, while simple annual growth rate calculates the average growth rate without compounding.

Can I use Excel’s built-in functions for CAGR calculation?

+Yes, Excel provides functions like RATE and XIRR that can be used to calculate CAGR. These functions offer flexibility and ease of use.