An amortization table is a valuable tool for understanding and managing loan repayments. It provides a clear breakdown of each payment, showing how the principal and interest are distributed over the loan term. This blog post will guide you through creating an amortization table in Excel, offering a step-by-step tutorial and insights into its benefits.

Setting Up the Amortization Table

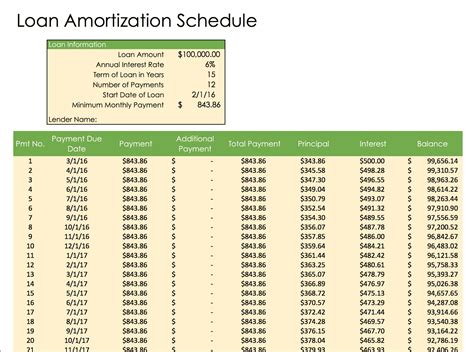

To begin, open a new Excel workbook and create a basic structure for your table. Here's a simple layout to get started:

- Column A: Payment Number

- Column B: Payment Date

- Column C: Beginning Balance

- Column D: Interest

- Column E: Principal

- Column F: Ending Balance

You can adjust the number of columns and rows as needed, but this basic framework will suffice for most loan amortization calculations.

Calculating Loan Payments

The first step is to calculate the monthly payment for your loan. Excel's PMT function can do this. The formula for the PMT function is as follows:

=PMT(rate, nper, pv, [fv], [type])

- rate: The interest rate for the loan.

- nper: The total number of payments for the loan.

- pv: The present value, or the total amount borrowed.

- fv: [Optional] The future value, or the desired balance after the last payment. If omitted, it defaults to 0 (zero), assuming the loan is paid off completely.

- type: [Optional] Specifies when payments are due. 0 (or omitted) indicates the end of the period, and 1 indicates the beginning of the period.

For example, if you have a loan with an interest rate of 5% (0.05), a term of 5 years (60 months), and a principal amount of $10,000, the formula would be:

=PMT(0.05/12, 60, 10000)

This formula calculates a monthly payment of $190.37.

Creating the Amortization Schedule

With the monthly payment calculated, you can now create the amortization schedule. Here's a step-by-step guide:

- In Cell A2, enter the label "Payment Number". This will be the first payment.

- In Cell B2, enter the label "Payment Date". Enter the date of the first payment.

- In Cell C2, enter the label "Beginning Balance". Input the loan amount ($10,000 in this example) as the beginning balance for the first payment.

- In Cell D2, enter the label "Interest". This is where you'll calculate the interest for the first payment.

- In Cell E2, enter the label "Principal". This is the portion of the payment that reduces the loan balance.

- In Cell F2, enter the label "Ending Balance". This is the loan balance after the first payment.

- In Cell D2, enter the formula =C2*RATE(NPER(rate, nper, pv), 1) to calculate the interest for the first payment. Replace rate, nper, and pv with your loan's values.

- In Cell E2, enter the formula =PM - D2 to calculate the principal for the first payment. Here, PM is the monthly payment calculated earlier.

- In Cell F2, enter the formula =C2 - E2 to calculate the ending balance after the first payment.

- Copy the formulas in Cells D2, E2, and F2 down to the remaining rows to calculate the interest, principal, and ending balance for each payment.

Your amortization table should now be complete! You can customize the table further by adding additional columns for fees, extra payments, or any other relevant information.

Understanding the Amortization Table

The amortization table provides a clear overview of your loan repayment journey. It allows you to see how each payment contributes to reducing the loan balance and how interest is calculated. Here are some key insights you can gain from the table:

- Payment Distribution: You can see how much of each payment goes towards interest and how much reduces the principal. This helps you understand the impact of your payments.

- Loan Progress: By tracking the ending balance, you can visualize the progress of your loan repayment. You'll see the balance gradually decrease over time.

- Interest Accrual: The table shows how interest accrues over the loan term. This is especially useful for understanding the early payments, where a larger portion goes towards interest.

- Extra Payment Impact: If you plan to make extra payments, you can see how they affect the loan balance and overall interest paid.

Tips for Customizing Your Amortization Table

- Conditional Formatting: Use conditional formatting to highlight important information. For example, you can format cells to change color based on the ending balance, making it easy to identify when the loan is almost paid off.

- Data Validation: Implement data validation to ensure accurate input. For instance, you can restrict the interest rate to a percentage format and limit the number of payments to ensure the calculation remains valid.

- Charts and Graphs: Consider adding charts or graphs to visualize your loan repayment progress. A line chart can show the decreasing loan balance over time, providing a visual representation of your repayment journey.

🌟 Note: The amortization table is a powerful tool for understanding and managing your loan repayments. By creating and analyzing this table, you can make informed decisions about your financial goals and track your progress effectively.

Conclusion

Creating an amortization table in Excel is a straightforward process that provides valuable insights into your loan repayment journey. By following the steps outlined in this blog, you can construct a comprehensive table that helps you understand how each payment impacts your loan balance and interest accrued. This tool is an excellent resource for financial planning and can assist you in making informed decisions about your loan repayment strategy.

FAQ

How often should I update my amortization table?

+It’s a good practice to update your amortization table whenever there are changes to your loan, such as extra payments or adjustments to the interest rate. Regular updates ensure that your table remains accurate and reflects the current status of your loan.

Can I use this table for multiple loans?

+Absolutely! You can create separate tabs within your Excel workbook for each loan. This way, you can easily manage and compare the repayment progress of multiple loans using the same amortization table structure.

What if I want to make extra payments to my loan?

+You can include a column in your amortization table to track extra payments. Simply add a column labeled “Extra Payment” and input the amount of any additional payments you make. The table will automatically adjust the loan balance and interest calculations to reflect these payments.

Is it possible to visualize the loan repayment progress with charts?

+Yes, Excel provides various chart options to visualize your loan repayment progress. You can create a line chart that plots the loan balance over time, showing how it decreases as you make payments. This visual representation can be a helpful tool for tracking your progress and motivating you to stay on track with your loan repayments.