Designing the Ultimate Balance Sheet in Excel: A Comprehensive Guide

Creating a well-structured balance sheet in Excel is essential for businesses to track their financial health. With a properly designed balance sheet, you can gain valuable insights into your company's assets, liabilities, and equity, enabling better decision-making. In this step-by-step guide, we will walk you through the process of designing an effective balance sheet in Excel, ensuring accuracy and ease of use.

Step 1: Set Up the Basic Structure

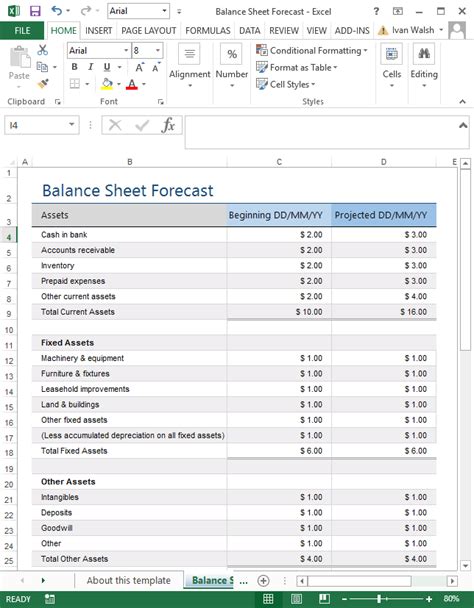

Begin by creating a new Excel workbook and dedicating a separate worksheet for your balance sheet. This ensures a clear separation from other financial data and reports.

In the first cell, enter the title "Balance Sheet" to clearly identify the sheet's purpose. Below this, create headers for the date, fiscal year, and any other relevant details you want to include, such as the company name or report period.

Next, insert a table with columns for the account, description, and amount. These columns will form the foundation of your balance sheet, allowing you to input and organize financial data effectively.

Step 2: Categorize Assets, Liabilities, and Equity

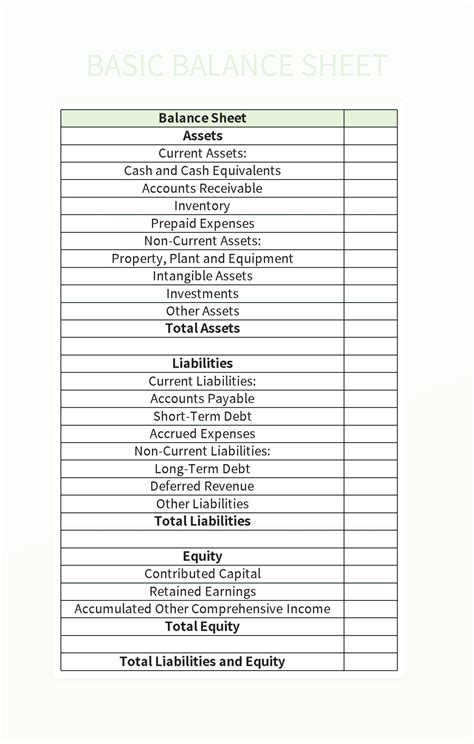

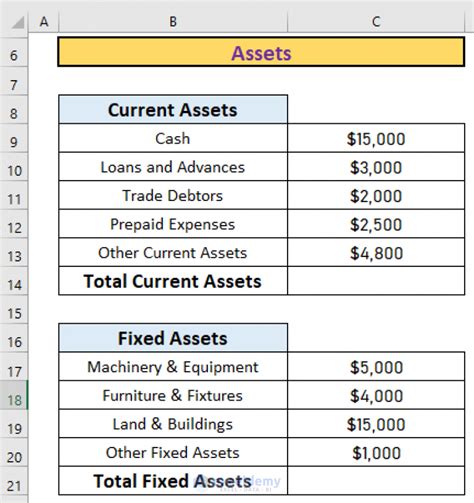

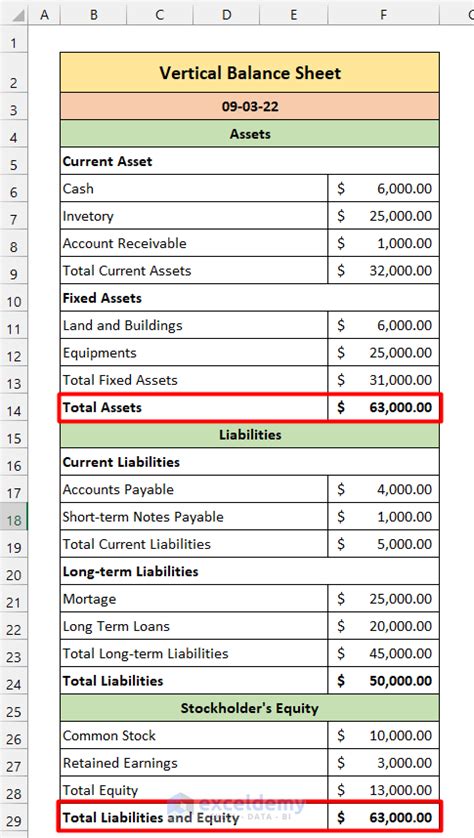

To ensure a clear and organized balance sheet, divide it into three main sections: Assets, Liabilities, and Equity. These sections represent the fundamental components of a balance sheet and provide a comprehensive overview of a company's financial position.

Under the Assets section, list all the company's assets, such as cash, accounts receivable, inventory, and property. Organize them in a logical order, starting with the most liquid assets and progressing to the least liquid ones. This hierarchical arrangement facilitates easier analysis and comparison.

Similarly, under the Liabilities section, list all the company's liabilities, including accounts payable, loans, and other financial obligations. Arrange them based on their maturity, with short-term liabilities appearing first, followed by long-term liabilities.

The Equity section represents the owners' stake in the company and includes items like common stock, retained earnings, and additional paid-in capital. Present these items in a way that reflects the company's capital structure and ownership hierarchy.

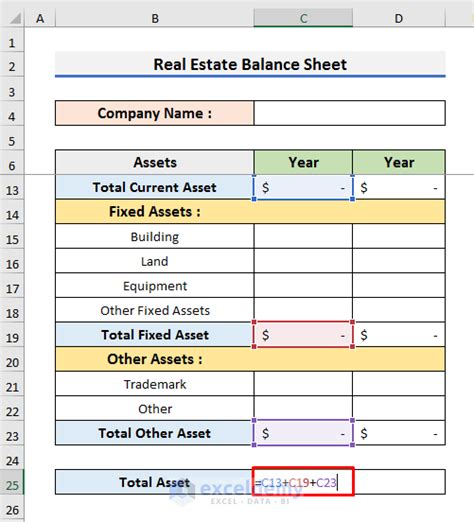

Step 3: Add Formulas for Calculations

Excel's strength lies in its ability to perform calculations, and this is especially valuable when creating a balance sheet. By adding formulas, you can automate various computations, making the balance sheet more dynamic and efficient.

For instance, you can use the SUM function to calculate the total assets, total liabilities, and total equity. This ensures accuracy and saves time by automatically updating the totals whenever new data is inputted.

Additionally, you can create formulas to calculate specific ratios or financial metrics. These ratios, such as the current ratio or debt-to-equity ratio, provide valuable insights into a company's financial health and stability. By incorporating these formulas into your balance sheet, you can easily track and analyze these key performance indicators.

Step 4: Incorporate Conditional Formatting

Conditional formatting is a powerful tool in Excel that allows you to visually highlight important information. By applying conditional formatting rules to your balance sheet, you can make it more intuitive and easier to interpret.

For example, you can format cells to change color based on the value they contain. Positive values could be formatted in green, while negative values could be formatted in red. This visual distinction makes it simple to identify areas of financial strength or concern at a glance.

You can also use conditional formatting to highlight changes in values over time. For instance, you can format cells to turn yellow if the current value is lower than the previous period's value, indicating a potential decline in performance.

Step 5: Include Charts and Graphs

Visual representations, such as charts and graphs, can greatly enhance the understanding and interpretation of financial data. By incorporating charts into your balance sheet, you can provide a more comprehensive view of your company's financial position.

Consider creating a pie chart to illustrate the composition of your assets or liabilities. This visual representation can help stakeholders quickly grasp the distribution of financial resources within your company.

Line charts or bar graphs can also be valuable in tracking changes in financial metrics over time. For example, you can plot the trend of your company's total assets or total liabilities over the past few years, providing a clear visual representation of financial growth or stability.

Step 6: Implement Data Validation

Data validation is crucial to ensure the accuracy and integrity of the information entered into your balance sheet. By implementing data validation rules, you can restrict the types of data that can be entered into specific cells, preventing errors and inconsistencies.

For example, you can set up data validation rules to ensure that only numeric values are entered in the amount column. This prevents users from accidentally entering text or special characters, which could lead to calculation errors.

You can also use data validation to create drop-down lists for certain cells. This is particularly useful for selecting specific accounts or categories, ensuring that the data entered aligns with the predefined options.

Conclusion

Designing an effective balance sheet in Excel is a crucial step towards gaining valuable financial insights for your business. By following these six simple steps, you can create a structured, dynamic, and visually appealing balance sheet that facilitates better decision-making. Remember to regularly update and review your balance sheet to stay on top of your company's financial health.

What is a balance sheet, and why is it important for businesses?

+A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It lists the company’s assets, liabilities, and equity, offering valuable insights into its financial health and stability. By analyzing the balance sheet, businesses can assess their financial strength, identify areas of improvement, and make informed decisions regarding investments, borrowing, and financial management.

How often should a balance sheet be updated and reviewed?

+The frequency of updating and reviewing a balance sheet depends on the nature of the business and its financial activities. Generally, it is recommended to update the balance sheet at the end of each accounting period, such as monthly, quarterly, or annually. Regular reviews allow businesses to track financial performance, identify trends, and make timely adjustments to their financial strategies.

Can I customize the appearance of my balance sheet in Excel?

+Absolutely! Excel offers a wide range of customization options to enhance the visual appeal of your balance sheet. You can apply different themes, color schemes, and font styles to make your balance sheet more aesthetically pleasing. Additionally, you can use Excel’s formatting tools to adjust cell borders, add shading, and create professional-looking headers and footers.

Are there any best practices for organizing data in a balance sheet?

+Yes, there are several best practices to consider when organizing data in a balance sheet. First, ensure that you consistently use clear and descriptive account names to avoid confusion. Group similar accounts together to enhance readability and facilitate analysis. Additionally, consider using subtotal rows or columns to provide a summary of specific categories, making it easier to understand the composition of assets, liabilities, and equity.

What are some common financial ratios derived from a balance sheet?

+Balance sheets provide the foundation for calculating various financial ratios that offer insights into a company’s financial performance and stability. Some common ratios derived from balance sheet data include the current ratio (current assets / current liabilities), debt-to-equity ratio (total liabilities / total equity), and return on assets (net income / total assets). These ratios help assess a company’s liquidity, solvency, and profitability.