Understanding the concept of heavy and light tails in probability theory is crucial for grasping the behavior of random variables and their distributions. This blog post will delve into the differences between heavy and light tails, exploring their characteristics, applications, and real-world examples. By the end, you'll have a comprehensive understanding of these tail types and their significance in various fields.

Heavy Tails: A Deeper Dive

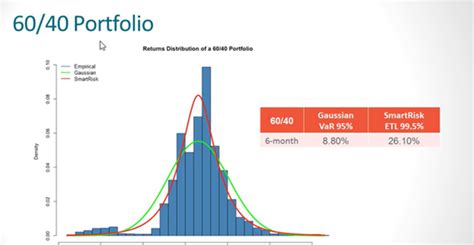

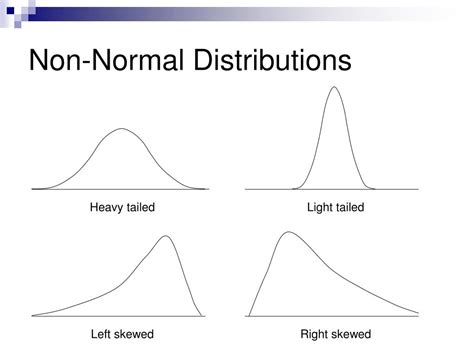

Heavy-tailed distributions, also known as fat tails or thick tails, are characterized by a slow decay rate in their probability density or mass functions. This means that the probability of observing extreme values far from the mean is relatively high compared to lighter-tailed distributions. In other words, heavy tails have a higher likelihood of producing outliers or extreme events.

One of the key features of heavy-tailed distributions is their long tails. These tails extend far beyond the mean, indicating that the distribution has a higher probability of producing values that are significantly larger or smaller than the average. As a result, heavy-tailed distributions are often associated with high variability and a greater chance of extreme events occurring.

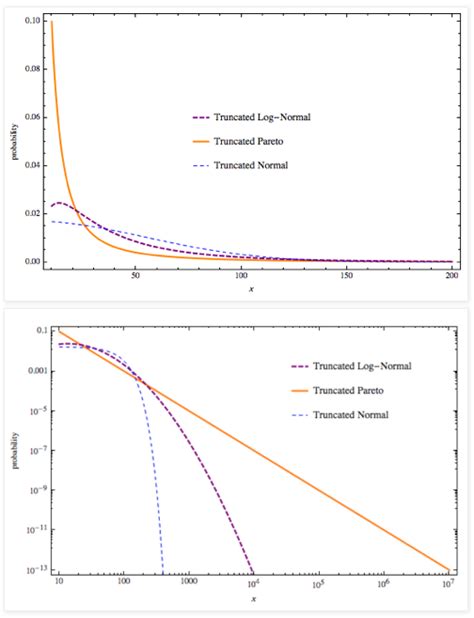

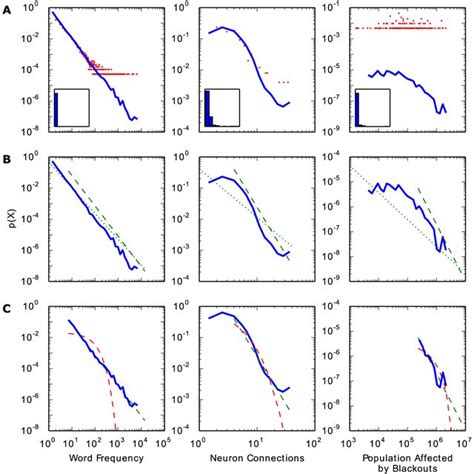

Mathematically, heavy-tailed distributions can be defined by their power-law decay or power-law behavior. This means that the probability density function (PDF) or probability mass function (PMF) decays as a power law, following the equation f(x) ~ x-α, where α is a positive constant. The value of α determines the tail index or tail heaviness, with larger values indicating heavier tails.

Some common examples of heavy-tailed distributions include the Cauchy distribution, Pareto distribution, and Stable distributions with α < 2. These distributions find applications in various fields, such as finance, where they are used to model stock market returns and extreme events like market crashes. In environmental sciences, heavy tails are used to model natural disasters like earthquakes and hurricanes.

Characteristics of Heavy-Tailed Distributions

- Slow Decay: The probability of extreme values decays slowly, resulting in a higher likelihood of observing outliers.

- Long Tails: The tails of the distribution extend far beyond the mean, indicating high variability.

- Power-Law Behavior: The probability density or mass function follows a power-law decay, characterized by the equation f(x) ~ x-α, where α is the tail index.

- High Variability: Heavy-tailed distributions exhibit greater variability compared to lighter-tailed distributions.

- Extreme Events: They are associated with a higher probability of extreme events occurring.

Applications of Heavy-Tailed Distributions

- Finance: Modeling stock market returns, option pricing, and risk management.

- Environmental Sciences: Predicting natural disasters like hurricanes, floods, and earthquakes.

- Insurance: Assessing the risk of extreme events and setting insurance premiums.

- Economics: Analyzing income inequality and wealth distribution.

- Network Analysis: Studying the behavior of complex networks, such as social networks and the Internet.

Light Tails: Exploring the Alternatives

In contrast to heavy tails, light-tailed distributions have a faster decay rate in their probability density or mass functions. This means that the probability of observing extreme values far from the mean is relatively low compared to heavy-tailed distributions. Light tails are characterized by a rapid decay and a concentration of probability mass near the mean.

Light-tailed distributions are often referred to as thin-tailed or short-tailed distributions. They exhibit low variability and a reduced chance of extreme events compared to heavy-tailed distributions. The probability density or mass function decays more rapidly, following an exponential or Gaussian-like decay.

Common examples of light-tailed distributions include the normal distribution, exponential distribution, and gamma distribution. These distributions are widely used in various fields due to their simplicity and ease of calculation. In statistics, the normal distribution is a fundamental tool for modeling continuous data, while the exponential distribution is commonly used to model waiting times and arrival processes.

Characteristics of Light-Tailed Distributions

- Rapid Decay: The probability of extreme values decays quickly, resulting in a lower likelihood of observing outliers.

- Short Tails: The tails of the distribution are relatively short, indicating low variability.

- Exponential or Gaussian Decay: The probability density or mass function follows an exponential or Gaussian-like decay.

- Low Variability: Light-tailed distributions exhibit lower variability compared to heavy-tailed distributions.

- Reduced Extreme Events: They have a lower probability of extreme events occurring.

Applications of Light-Tailed Distributions

- Statistics: Modeling continuous data, such as height, weight, and IQ scores.

- Quality Control: Assessing the variability of manufacturing processes and product quality.

- Reliability Analysis: Estimating the reliability and failure rates of systems and components.

- Econometrics: Analyzing economic data and forecasting future trends.

- Engineering: Designing and optimizing systems with known failure rates.

Comparing Heavy and Light Tails

To better understand the differences between heavy and light tails, let's compare their key characteristics side by side.

| Characteristic | Heavy Tails | Light Tails |

|---|---|---|

| Decay Rate | Slow | Rapid |

| Tail Length | Long | Short |

| Tail Behavior | Power-law decay | Exponential or Gaussian decay |

| Variability | High | Low |

| Extreme Events | High probability | Low probability |

Real-World Examples

Heavy Tails in Action

- Stock Market Returns: The distribution of stock market returns often exhibits heavy tails, indicating the possibility of large gains or losses.

- Income Inequality: The distribution of income across a population can have heavy tails, reflecting the presence of a small number of high-income individuals.

- Natural Disasters: The frequency and severity of natural disasters, such as hurricanes or earthquakes, can be modeled using heavy-tailed distributions.

Light Tails in Practice

- Height Distribution: The distribution of human height is often modeled using a normal distribution, a light-tailed distribution.

- Manufacturing Quality: The variability of a manufacturing process can be assessed using light-tailed distributions, such as the exponential distribution.

- System Reliability: The reliability of a system or component can be estimated using light-tailed distributions, like the gamma distribution.

Choosing the Right Tail Type

When analyzing data or modeling a phenomenon, it's essential to choose the appropriate tail type based on the characteristics of the data and the problem at hand. Here are some guidelines to help you decide between heavy and light tails:

- Data Analysis: Examine the distribution of your data. If it exhibits long tails and a higher likelihood of extreme values, a heavy-tailed distribution may be more suitable. On the other hand, if the data has a concentration of values near the mean and a low probability of extreme events, a light-tailed distribution is likely a better choice.

- Problem Context: Consider the nature of the problem you are trying to solve. If you are dealing with a system or process that is known to have high variability and a significant risk of extreme events, heavy-tailed distributions are often more appropriate. In contrast, if the system is relatively stable and extreme events are rare, light-tailed distributions can provide a simpler and more accurate representation.

📈 Note: The choice between heavy and light tails depends on the specific characteristics of your data and the problem context. It's important to analyze your data thoroughly and consider the potential implications of each tail type before making a decision.

Conclusion

In this blog post, we explored the differences between heavy and light tails in probability theory. We delved into the characteristics, applications, and real-world examples of each tail type, highlighting their unique properties and uses. By understanding the behavior of heavy and light tails, you can make informed decisions when modeling and analyzing data, ensuring accurate and reliable results.

Whether you're dealing with extreme events in finance, modeling natural disasters, or assessing the reliability of a system, the choice between heavy and light tails is crucial. By choosing the appropriate tail type, you can gain valuable insights and make more informed decisions in various fields, from finance to environmental sciences and beyond.

FAQ

What are heavy-tailed distributions used for in finance?

+

Heavy-tailed distributions, such as the Cauchy distribution, are used in finance to model stock market returns and extreme events like market crashes. They capture the high variability and potential for large gains or losses in financial markets.

Can light-tailed distributions be used to model income distribution?

+

While light-tailed distributions, like the normal distribution, are commonly used to model continuous data, they may not be suitable for modeling income distribution. Income distribution often exhibits heavy tails due to the presence of a small number of high-income individuals.

What is the tail index in heavy-tailed distributions?

+

The tail index, denoted by α, represents the heaviness of the tails in heavy-tailed distributions. It determines the rate of decay in the probability density or mass function. Larger values of α indicate heavier tails.

Are heavy-tailed distributions always better for modeling extreme events?

+

While heavy-tailed distributions are often associated with extreme events, they may not always be the best choice. The appropriateness of heavy-tailed distributions depends on the specific characteristics of the data and the problem context. In some cases, light-tailed distributions can provide a simpler and more accurate representation.

Can light-tailed distributions be used for risk management in finance?

+Light-tailed distributions, such as the normal distribution, are commonly used for risk management in finance. However, they may not capture the full range of potential outcomes, especially extreme events. In such cases, heavy-tailed distributions are often preferred.