The Home Equity Line of Credit (HELOC) payment calculator in Excel is a powerful tool that can assist homeowners in managing their finances and understanding the repayment process for their HELOC. This calculator provides an easy way to estimate monthly payments, track interest, and plan for the future. In this blog post, we will guide you through the process of creating and using a HELOC payment calculator in Excel, offering a comprehensive step-by-step tutorial.

Setting Up the HELOC Payment Calculator

Before diving into the calculations, it's essential to set up your Excel spreadsheet properly. Here's how you can get started:

- Create a New Worksheet: Open a new Excel workbook and create a dedicated worksheet for your HELOC payment calculator.

- Label the Columns: In the first row, label the columns with relevant information such as Date, Payment, Principal, Interest, and Balance.

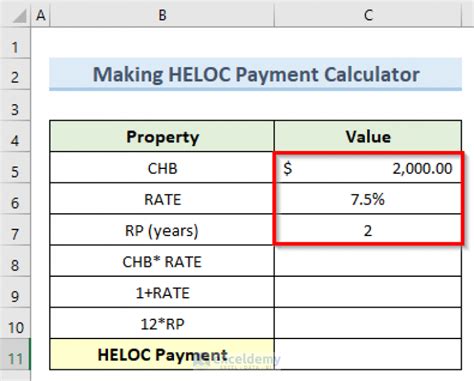

- Input Initial Values: In the first row below the labels, input the initial values for your HELOC, including the Starting Balance, Interest Rate, and Repayment Period (in months).

Formulas for Calculations

Now, let's dive into the formulas you'll need to calculate the monthly payments, interest, and remaining balance for your HELOC:

-

Monthly Payment Formula: In the cell below the Payment label, use the following formula:

=PMT(interest_rate, repayment_period, starting_balance). Replace the placeholders with the corresponding cell references. This formula calculates the monthly payment required to pay off the HELOC within the specified repayment period. -

Interest Calculation: To calculate the interest for each month, use the formula:

=starting_balance * interest_rate. This formula multiplies the current balance by the monthly interest rate to find the interest accrued for that month. -

Principal Payment: The principal payment for each month can be calculated by subtracting the interest from the monthly payment:

=monthly_payment - interest. -

Remaining Balance: To find the new balance after each payment, subtract the principal payment from the previous balance:

=previous_balance - principal_payment.

Copy and paste these formulas down the respective columns to calculate the payments, interest, and balance for each month of the repayment period.

Using the HELOC Payment Calculator

Once you've set up the calculator and input the initial values, you can use it to estimate your monthly payments and track your HELOC repayment progress. Here's how:

- Enter Payment Dates: In the Date column, enter the dates for each month of the repayment period.

- Input Actual Payments: If you make payments toward your HELOC, input the actual payment amounts in the Payment column for the corresponding dates.

- Track Interest and Principal: The calculator will automatically update the interest and principal payments based on your actual payments and the remaining balance.

- Monitor Balance: Keep an eye on the Balance column to see how your payments are reducing the outstanding balance.

Customizing the Calculator

The HELOC payment calculator in Excel is highly customizable, allowing you to adapt it to your specific needs. Here are some customization options:

- Adjust Repayment Period: If your repayment period changes, simply update the Repayment Period value in the initial input section. The calculator will recalculate the monthly payments accordingly.

- Change Interest Rate: If the interest rate on your HELOC changes, update the Interest Rate value. The calculator will adjust the interest and payment calculations based on the new rate.

- Add Additional Columns: You can add extra columns to track other relevant information, such as minimum payments, late fees, or extra payments made.

Tips and Best Practices

To ensure the accuracy and effectiveness of your HELOC payment calculator, consider the following tips:

- Keep It Simple: Start with a basic calculator and gradually add complexity as needed. A simple calculator is easier to understand and maintain.

-

Use Named Ranges: Assign names to the important cell ranges, such as

starting_balance,interest_rate, andrepayment_period. This makes the formulas more readable and easier to update. - Use Conditional Formatting: Apply conditional formatting to highlight important information, such as negative balances or late payments.

- Create a Payment Schedule: Generate a payment schedule by copying and pasting the calculator data into a new worksheet. This can be helpful for budgeting and planning.

Conclusion

Creating a HELOC payment calculator in Excel empowers you to take control of your finances and manage your HELOC repayment effectively. By following the steps outlined in this blog post, you can build a customized calculator that suits your needs. Remember to regularly update your calculator with actual payments and interest rates to ensure accurate tracking. With this tool, you can make informed decisions about your HELOC and work towards becoming debt-free.

FAQ

Can I use this calculator for multiple HELOCs?

+Yes, you can create separate worksheets within the same Excel workbook for each HELOC you have. This allows you to track and compare the repayment progress of multiple HELOCs.

How often should I update the calculator with actual payments?

+It’s recommended to update the calculator with actual payments at the end of each month to ensure accurate tracking. This way, you can see the impact of your payments on the remaining balance.

Can I modify the calculator to include extra payments?

+Absolutely! You can customize the calculator to account for extra payments by adding a column for the additional payment amounts. Adjust the formulas to include these payments in the balance calculation.

Is it possible to visualize the repayment progress with charts?

+Yes, you can create charts in Excel to visualize the repayment progress. For example, you can create a line chart to track the reduction in the balance over time or a bar chart to compare monthly payments.