The NPER function in Excel is a powerful tool that allows you to calculate the number of periods required to pay off a loan or investment. It's an essential function for financial planning and analysis, helping you determine the time needed to reach your financial goals. In this blog post, we will explore the NPER function in detail, understanding its syntax, usage, and practical applications.

Understanding the NPER Function

The NPER function in Excel calculates the number of periods for an investment or loan based on constant payments and a constant interest rate. It is particularly useful when you want to know how long it will take to repay a loan or achieve a specific investment goal.

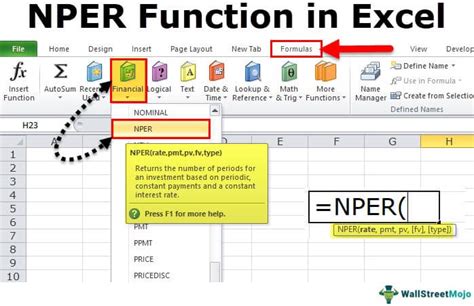

The syntax of the NPER function is as follows:

NPER(rate, pmt, pv, [fv], [type])

- rate: This is the interest rate for each period. It should be entered as a decimal value.

- pmt: The payment made each period. It should be entered as a negative number to represent cash outflow.

- pv: The present value, or the total amount that a series of future payments is worth now.

- [fv]: Optional. The future value, or the targeted balance that you want to achieve after the last payment. If omitted, it defaults to 0.

- [type]: Optional. Specifies when payments are due. 0 indicates the end of the period, and 1 indicates the beginning of the period. If omitted, it defaults to 0.

Calculating Loan Repayment Periods

Let's consider an example where you have taken out a loan to purchase a car. You want to know how many months it will take to repay the loan if you make monthly payments of $500 with an annual interest rate of 6%.

- Open Excel and insert the values into the appropriate cells.

- In an empty cell, enter the formula:

NPER(rate, pmt, pv, [fv], [type]) - Replace the variables with your values:

rate: Enter the monthly interest rate. To convert the annual interest rate to monthly, divide it by 12. So, for 6% annual interest, the monthly rate would be 0.5% (6% / 12 = 0.5%).pmt: Enter the monthly payment amount as a negative value (-$500 in this case)pv: Enter the present value, which is the loan amount.[fv]and[type]: These are optional and can be left blank.

- The formula should look something like this:

NPER(0.5%, -$500, $20000) - Press Enter, and Excel will calculate the number of periods (in this case, months) required to repay the loan.

Calculating Investment Growth Periods

The NPER function can also be used to determine how long it will take for an investment to reach a certain value. For example, you have invested $10,000 in a mutual fund with an annual interest rate of 8%, and you want to know how many years it will take to double your investment.

- Open Excel and input the values into the appropriate cells.

- In an empty cell, enter the formula:

NPER(rate, pmt, pv, [fv], [type]) - Replace the variables with your values:

rate: Enter the annual interest rate as a decimal (8% becomes 0.08)pmt: Enter 0, as there are no regular payments being made.pv: Enter the initial investment amount.[fv]: Enter the future value you want to achieve (in this case, $20,000)[type]: Leave it blank or set it to 0.

- The formula should look like this:

NPER(0.08, 0, $10000, $20000) - Press Enter, and Excel will calculate the number of periods (in years) required for your investment to double.

Common Errors and Tips

- Negative Values: Ensure that the

pmtvalue is entered as a negative number to represent cash outflow. Forgetting to do so can lead to incorrect results. - Present Value: The

pvvalue should represent the total amount of the loan or investment. It is a critical input for accurate calculations. - Understanding Interest Rates: Always convert annual interest rates to the appropriate period (monthly, quarterly, etc.) to ensure accurate calculations.

- Optional Arguments: The

[fv]and[type]arguments are optional but can be useful in certain scenarios. Leaving them blank or setting them to their default values is generally fine for most calculations.

Conclusion

The NPER function in Excel is a versatile tool for financial planning. Whether you're managing loans or planning investments, understanding how to use this function can help you make informed decisions. By following the steps outlined in this blog post, you can confidently calculate the number of periods required to achieve your financial goals.

Can I use the NPER function for irregular payments or varying interest rates?

+The NPER function assumes constant payments and a constant interest rate. For irregular payments or varying interest rates, you might need to use more advanced financial functions or tools.

What happens if I leave the [fv] argument blank in the NPER function?

+If you leave the [fv] argument blank, it defaults to 0. This means the function will calculate the number of periods required to pay off the present value (pv) with the given payment (pmt) and interest rate (rate).

How accurate are the results of the NPER function in Excel?

+The NPER function provides accurate results as long as you input the correct values and understand the assumptions it makes. Always double-check your inputs and ensure they align with your specific financial situation.