Managing your finances is crucial for both personal and business success, and Excel offers powerful tools to help you keep track of your running balance. Whether you're an entrepreneur, a small business owner, or simply want to monitor your personal finances, this comprehensive guide will walk you through the process of setting up a running balance sheet in Excel, providing you with the insights you need to make informed financial decisions.

Understanding the Running Balance

The running balance is a crucial financial metric that provides a snapshot of your financial health at any given time. It represents the cumulative balance of your account, taking into account all transactions made up to that point. By tracking your running balance, you can easily identify patterns, detect anomalies, and make adjustments to your financial strategies.

Setting Up Your Excel Worksheet

To create a running balance sheet in Excel, follow these steps:

- Open a new Excel workbook and create a new worksheet.

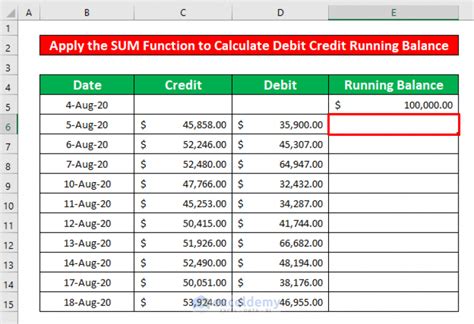

- In the first row, enter the labels for your columns. For example, you can have columns for Date, Description, Debit, Credit, and Running Balance.

- In the Date column, enter the dates of your transactions. You can use the date format (mm/dd/yyyy) or simply type the date manually.

- In the Description column, provide a brief description of each transaction. This could be the name of the payee, the purpose of the transaction, or any other relevant information.

- In the Debit and Credit columns, enter the amounts for each transaction. Use positive numbers for credits and negative numbers for debits.

Here's an example of how your worksheet might look after entering some sample data:

| Date | Description | Debit | Credit | Running Balance |

|---|---|---|---|---|

| 01/01/2023 | Salary | 5000 | 5000 | |

| 01/02/2023 | Groceries | -200 | 4800 | |

| 01/03/2023 | Rent | -1200 | 3600 | |

| 01/04/2023 | Freelance Work | 800 | 4400 |

Calculating the Running Balance

To calculate the running balance, you'll need to use Excel's formula capabilities. Here's how you can do it:

- In the Running Balance column, click on the cell where you want to start calculating the running balance. For this example, let's assume you want to start from the second row.

- Enter the formula

=SUM(Credit) - SUM(Debit)in the selected cell. This formula will calculate the sum of all credits and subtract the sum of all debits up to that point. - Drag the fill handle (the small square in the bottom-right corner of the selected cell) down to the last row of your data. This will automatically calculate the running balance for each row.

Your running balance column should now display the cumulative balance for each transaction.

Customizing Your Running Balance Sheet

Once you have the basic running balance sheet set up, you can customize it further to suit your needs:

- Formatting: Apply formatting to your worksheet to enhance readability. You can change the font, adjust cell borders, and apply conditional formatting to highlight important values.

- Charts and Graphs: Create visual representations of your data using charts and graphs. This can help you identify trends and make more informed financial decisions.

- Data Validation: Implement data validation rules to ensure accurate data entry. For example, you can restrict the values in the Debit and Credit columns to only allow numeric input.

- Formulas and Functions: Explore Excel's vast library of formulas and functions to perform more complex calculations. You can calculate averages, totals, and even use financial functions to analyze your data further.

Tips for Effective Running Balance Management

Here are some tips to help you effectively manage your running balance and make the most out of your Excel worksheet:

- Update your running balance sheet regularly to stay on top of your finances. Aim to enter transactions as soon as they occur to maintain accurate records.

- Reconcile your running balance with your bank statements to ensure accuracy. Regularly compare your Excel data with your bank's records to identify any discrepancies.

- Use Excel's filtering and sorting features to analyze specific transactions or periods. This can help you identify patterns and make informed decisions based on historical data.

- Consider using Excel's pivot tables to summarize and analyze your data in different ways. Pivot tables allow you to quickly calculate totals, averages, and other metrics for different categories.

Automating Your Running Balance Sheet

If you want to streamline the process of updating your running balance sheet, you can consider automating certain tasks using Excel's features or even programming languages like VBA (Visual Basic for Applications). Here are some automation techniques you can explore:

- Data Import: If you have your transaction data in another file or database, you can use Excel's data import features to automatically pull the data into your running balance sheet. This can save you time and reduce the risk of manual entry errors.

- Macros: Excel's macros allow you to record and replay a series of actions. You can record a macro to automate the process of entering transactions, calculating the running balance, and formatting the worksheet.

- VBA Programming: For more advanced automation, you can write VBA code to interact with Excel's objects and perform complex tasks. This can include automating data entry, applying custom formulas, and generating reports.

Conclusion

Managing your running balance in Excel is a powerful way to gain insights into your financial health and make informed decisions. By following the steps outlined in this guide, you can create a comprehensive running balance sheet that suits your needs. Remember to regularly update and reconcile your data, utilize Excel's features to enhance your analysis, and consider automation techniques to streamline your financial management process.

How often should I update my running balance sheet?

+It’s recommended to update your running balance sheet on a regular basis, preferably after each transaction. This ensures that your financial records are up-to-date and accurate. However, if you have a large number of transactions, you can set a schedule to update your sheet periodically, such as daily, weekly, or monthly.

Can I use Excel to track multiple accounts simultaneously?

+Yes, Excel allows you to track multiple accounts in separate worksheets or even in different workbooks. You can create a master workbook that consolidates the running balances from different accounts, providing you with a comprehensive overview of your financial situation.

Are there any alternative software or apps for managing running balances?

+Yes, there are several personal finance management software and apps available that can help you track your running balance. These tools often offer additional features like budgeting, expense tracking, and investment management. Some popular options include Mint, YNAB (You Need a Budget), and Personal Capital.

Can I share my running balance sheet with others?

+Absolutely! Excel allows you to share your workbook with others by saving it in a shared location or using cloud storage services like OneDrive or Google Drive. You can also export your running balance sheet to a PDF or CSV file, which can be easily shared and opened on different devices.

What if I need to make changes to my running balance sheet after calculating the running balance?

+If you need to make changes to your running balance sheet after calculating the running balance, simply update the relevant cells in the Debit, Credit, or Date columns. Excel will automatically recalculate the running balance based on the new values. Just ensure that you maintain consistency in your data entry to avoid errors.