Short selling restricted stocks is a complex process that requires careful consideration and an understanding of the regulations involved. This practice is often surrounded by myths and misconceptions, so let's delve into the intricacies of shorting restricted stocks to shed some light on this intriguing aspect of the financial market.

Understanding Restricted Stocks

Restricted stocks, also known as control securities, are shares that have specific restrictions placed on them by the Securities and Exchange Commission (SEC). These restrictions can limit the transferability of the shares, and they are typically imposed on insiders, such as company officers, directors, and significant shareholders.

The restrictions can take various forms, but the most common is a lock-up period, during which the holder is prohibited from selling or transferring the shares. This period is designed to prevent the insider from dumping a large number of shares on the market, which could negatively impact the stock price. Other restrictions might include volume limitations or a requirement to obtain pre-approval from the SEC before selling.

The Process of Shorting Restricted Stocks

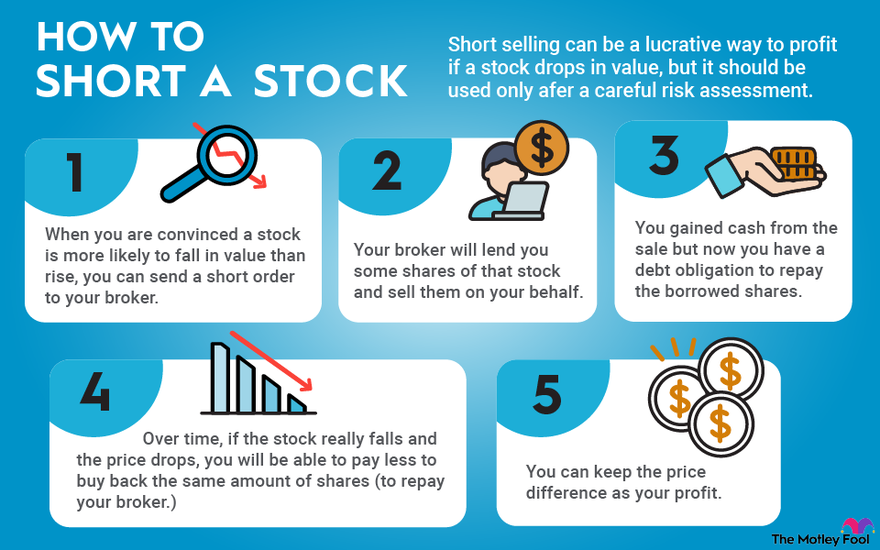

Shorting restricted stocks is a more complex process than shorting unrestricted stocks, primarily due to the additional restrictions and regulations involved. Here's a simplified breakdown of the process:

- Identify Restricted Stocks: The first step is to identify stocks that are subject to restrictions. This can be done by researching the company's SEC filings, which will outline any restrictions on the company's shares.

- Locate a Broker: Not all brokers allow shorting of restricted stocks. You'll need to find a broker that specializes in this area and has the necessary clearance procedures in place.

- Borrow the Shares: To short a stock, you need to borrow the shares from someone who owns them. This is where the complexity arises, as finding someone willing to lend restricted shares can be challenging. Prime brokers or specialist lenders may be able to help, but it's a process that requires careful negotiation.

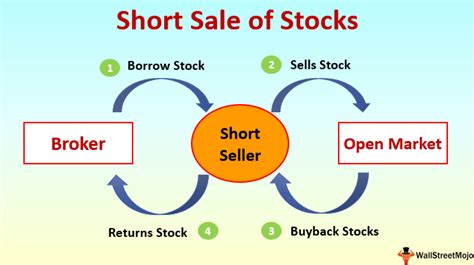

- Execute the Short Sale: Once you've borrowed the shares, you can proceed with the short sale. This involves selling the borrowed shares on the open market, with the aim of buying them back at a lower price in the future.

- Manage the Position: Shorting restricted stocks requires ongoing management. You'll need to keep a close eye on the stock's price movement and be prepared to cover your short position if the price rises unexpectedly.

Risks and Considerations

Shorting restricted stocks comes with a unique set of risks and considerations, including:

- Limited Liquidity: Restricted stocks often have lower trading volumes, which can make it challenging to enter and exit positions quickly.

- Increased Borrowing Costs: Borrowing restricted stocks can be more expensive due to the lower availability and the increased risk associated with them.

- Regulatory Compliance: You must ensure that your shorting activities comply with all relevant regulations. Failure to do so can result in significant penalties.

- Stock Price Volatility: Restricted stocks can be more volatile, particularly if they are subject to news or events that impact the company's prospects.

Additionally, it's important to note that shorting restricted stocks is a highly speculative practice and should only be undertaken by experienced investors who fully understand the risks involved.

Tips for Shorting Restricted Stocks

If you're considering shorting restricted stocks, here are some tips to keep in mind:

- Research Thoroughly: Understand the company, its business, and the specific restrictions on its shares.

- Choose the Right Broker: Select a broker with experience in handling restricted stock short sales and ensure they have the necessary resources and expertise.

- Manage Risk: Implement strict risk management strategies, including stop-loss orders and regular position reviews.

- Stay Informed: Keep up-to-date with news and events that could impact the stock's price.

- Consider Alternatives: Restricted stocks are not the only investment option. Evaluate other opportunities before committing to this complex strategy.

Conclusion

Shorting restricted stocks is a sophisticated strategy that requires a deep understanding of the market and a willingness to navigate complex regulations. While it can be a profitable venture for experienced investors, it's essential to approach this strategy with caution and a comprehensive risk management plan. As with any investment, due diligence and a clear understanding of the risks are paramount.

What are the main risks associated with shorting restricted stocks?

+

The main risks include limited liquidity, increased borrowing costs, regulatory compliance issues, and stock price volatility. It’s crucial to have a robust risk management plan in place when shorting restricted stocks.

How can I find a broker that allows shorting of restricted stocks?

+

You’ll need to research and reach out to brokers that specialize in handling restricted stock short sales. Prime brokers or specialist lenders may be able to assist with this process.

Are there any alternatives to shorting restricted stocks?

+

Yes, there are other investment strategies and opportunities available. It’s essential to evaluate your options and choose the strategy that aligns best with your investment goals and risk tolerance.